What You Need to Know About Real Estate When Relocating Staff to Canada (Ontario and British Columbia – NRST)

Recruitment for the right talent may make Corporations seek that talent worldwide. To attract the right candidate is a huge commitment for the Corporation and even a bigger one for any employee. Along with the many issues and concerns they may have, the biggest one for the employee and family is housing.

Rules for all employees in Canada on a VISA, who are looking to purchase in Ontario, just got tougher effective March 30, 2022. As well, moving to areas of British Columbia have similar costly issues.

Corporations have to determine if they are going to assist employees with this additional tax. If not, it is the responsibility of the employee to absorb the cost with the knowledge it may be reclaimed down the road.

What is the Non-resident Speculation Tax (NRST) or Foreign Buyer Tax?

The National-resident Speculation Tax (NRST) or the Foreign Buyer Tax was first introduced into two areas of Canada, British Columbia, and Ontario in 2016 and 2017.

This Tax was enacted to address the hot housing markets in these two areas and to help alleviate the rapid increase in home prices.

How much is the Foreign Buyers Tax and Where does it apply:

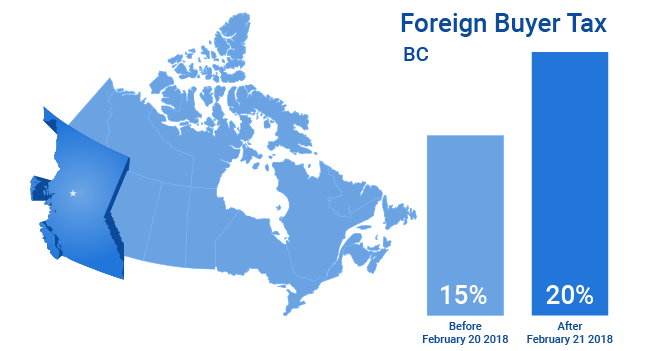

In British Columbia:

The current tax rate is a 20% addition to the property transfer tax.

Prior to February 20, 2018, the tax amount was 15% of the fair market value of the buyer’s proportionate share. After February 21, 2018, the tax amount became 20% of the fair market value of the Buyer’s proportionate share. The proportionate share is the percentage of interest that is being registered on title with the Land Title Office.

CALCULATE British Columbia Land Transfer Tax (NRST) Now!

In British Columbia there are many cities and electoral districts affected by the Foreign Buyer Tax in the following locations:

- Capital Regional District

- Fraser Valley Regional District

- Metro Vancouver Regional District

- Regional District of the Central Okanagan

- Regional District of Nanaimo

Refund for BC Foreign Buyers Tax

![]()

The buyer may also be eligible for a refund on the tax if they became a Canadian citizen or permanent resident within one year of the date the property transfer was registered with the Land Title and Survey Office.

- City of Barrie

- County of Brant

- City of Brantford

- County of Dufferin

- Regional Municipality of Durham

- City of Guelph

- Haldimand County

- Regional Municipality of Halton

- City of Hamilton

- City of Kawartha Lakes

- Regional Municipality of Niagara

- County of Northumberland

- City of Orillia

- Regional Municipality of Peel

- City/County of Peterborough

- County of Simcoe

- City of Toronto

- Regional Municipality of Waterloo

- County of Wellington, and

- Regional Municipality of York

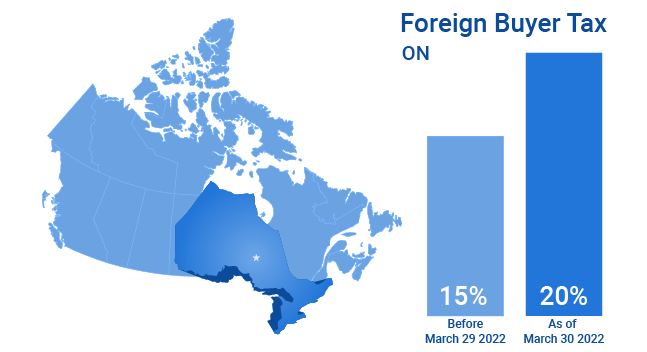

In Ontario:

Effective March 30, 2022, the NRST rate increased to 20 per cent and expanded province wide. As a result, the NRST may apply on the purchase or acquisition of an interest in residential property located anywhere in Ontario by individuals who are foreign nationals. The NRST applies in addition to the general Land Transfer Tax (LTT) in Ontario.

Effective March 30, 2022, the NRST rate increased to 20 per cent and expanded province wide. As a result, the NRST may apply on the purchase or acquisition of an interest in residential property located anywhere in Ontario by individuals who are foreign nationals. The NRST applies in addition to the general Land Transfer Tax (LTT) in Ontario.

Prior to March 30, 2022, the NRST was a 15 per cent tax on the purchase of an interest in residential property in the Greater Golden Horseshoe Region. Foreign nationals who entered into Agreements of Purchase and Sale on or before March 29, 2022, will only be subject to the 15% NRST. Only residential properties purchased in the Greater Golden Horseshoe area will be subject to NRST and rebates in accordance with the original agreement.

CALCULATE Ontario Land Transfer Tax (NRST) Now!

In Ontario the tax is applied to any real estate purchased in the Greater Golden Horseshoe including :

Refund of NRST in Ontario

![]() A rebate of the NRST was available for buyers up to March 30, 2022, under the following situations:

A rebate of the NRST was available for buyers up to March 30, 2022, under the following situations:

- The foreign national becomes a permanent resident of Canada within four years of the date of the purchase or acquisition

- The foreign national has legally worked full-time under a valid work permit in Ontario for a continuous period of at least one year since the date of purchase or acquisition.

As of March 30, 2022, rebates on NRST paid are now only available to foreign nationals who become permanent residents of Canada within four (4) years of the purchase closing date, live at the property as their principal residence and apply for the rebate within 90 days of becoming permanent residents

Who Is Liable for the NRST or Foreign Buyer’s Tax?

Individuals that are liable for the NRST or Foreign Buyer’s Tax include foreign nationals, foreign corporations, and taxable trustees.

Individuals that are liable for the NRST or Foreign Buyer’s Tax include foreign nationals, foreign corporations, and taxable trustees.

Foreign Nationals

A foreign national is an individual that is not a Canadian citizen or a permanent resident of the province. For instance, if you live in Europe or the United States and purchase a residential property in Ontario, you will be subject to the foreign buyer’s tax.

When is the Employee Required to Pay the NRST or Foreign Buyer Tax?

These additional taxes must be paid when the property is purchased by anyone who is not a citizen or a permanent resident of Canada unless they fit one of the exemption categories. As well, payment for this tax cannot be added to the mortgage amount. It is important to remember that any Transfer Tax is also due on closing of the purchase.

Exemptions to the NRST or Foreign Buyer’s Tax

There are a few exemptions to the foreign buyer’s tax. These exemptions allow an otherwise liable person to avoid paying the additional fee.

Some of these exemptions are:

- Tax does not apply if you are a permanent resident or citizen of Canada.

- If you pay the tax but later become a citizen or permanent resident, you may be eligible for a rebate of what you paid. You must become a citizen within four years for this rebate to apply.

- Those applying for landed immigrant status do not need to pay the tax.

- Spouse: A foreign national who jointly purchases residential property with a spouse, who is a Canadian citizen, permanent resident of Canada, nominee, or protected person.

- Nominee – A foreign national who is nominated under the Ontario Immigrant Nominee Program (nominee) at the time of the purchase or acquisition, and the foreign national has applied or certifies that they will apply to become a permanent resident of Canada

- Protected person – A foreign national on whom refugee protection is conferred (protected person) under section 95 of the Immigration and Refugee Protection Act (Canada) at the time of the purchase or acquisition.

Otherwise, every residential purchase in these two areas of Canada, made by non-citizens (including foreign corporations), will be liable for this additional tax.

Types of Property Subject to the NRST or Foreign Buyer Tax

The Tax applies to the transfer of land which contains at least one and not more than six single family residences.

The Tax applies to the transfer of land which contains at least one and not more than six single family residences.

Examples of land containing one single family residence include land containing:

- A detached house

- A semi‑detached house

- A townhouse, or

- A condominium unit.

In a situation involving the purchase of multiple condominium units, each unit would be considered land containing one single family residence.

Examples of land containing more than one single family residence that are subject to the tax include land containing duplexes, triplexes, fourplexes, fiveplexes and sixplexes.

The Tax does not apply to other types of land such as land containing multi‑residential rental apartment buildings with more than six units, agricultural land, commercial land, or industrial land. It is important to note that only the residential property portion of the purchase price is included in this calculation. If any other excluded property type, like agricultural land, is purchased, the tax will not apply to that portion.

The Tax applies on the value of the consideration for the residential property. If the land transferred includes both residential property and another type of property, the Tax applies only on the portion of the value of the consideration attributable to the residential property.

For example, if the purchase price of the transaction is $1,000,000 and contains one single family residence with a value of the consideration of $400,000, and commercial land with a value of the consideration of $600,000, the 20 per cent tax would apply to only the $400,000 portion.

How Can the Corporation Assist?

Although some corporations do offer some form of assistance others leave the decision to purchase up to the employee. Now that the rules in Ontario have expanded, it may be time to review your international policy.

Although some corporations do offer some form of assistance others leave the decision to purchase up to the employee. Now that the rules in Ontario have expanded, it may be time to review your international policy.

Contact TransferEASE Relocation Inc. to discuss your options at www.transrelo.com.